Global growth in consumer health is expected to reach 2% in 2021, up only slightly from 1.8% in 2020, as the fitful pace of reopenings over the course of 2021 allowed for marginal improvements in consumer spend in categories suppressed during the height of the pandemic in 2020. The persistence of the spread of Coronavirus (COVID-19) and the still-ongoing efforts to vaccinate consumers across the globe have limited the pace of growth in 2021.

The relatively consistent year-on-year growth for consumer health as a whole masks wild rebounds at the category level. On one extreme, the significant growth (6.1% globally) in vitamins and dietary supplements (VDS) in 2020 due to interest in disease prevention is expected to drop to just 1.7% in 2021, as consumer interest in immunity functionality has waned considerably from the unsustainable rates of 2020. On the other side, interest in sports nutrition is expected to jump (from a decline of 2.6% in 2020 to growth of 6.4% in 2021) as usage occasions have improved with the reopening of gyms and the broadened interest in staying fit and healthy as a result of the pandemic. OTC drugs are expected to see stronger growth in 2021 as well, as limitations to movement, gatherings, and schooling have eased, though continued restrictions in many countries subdued growth for cough and cold remedies for another year.

Return to historic rates of mergers and acquisitions

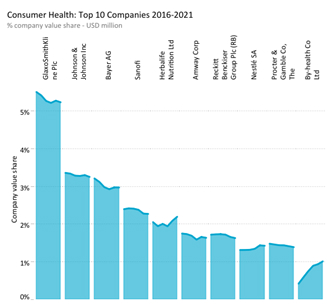

Amid the uncertainty and precarity of the pandemic, mergers and acquisitions dried up considerably in 2020, with many of the leading global players instead shedding underperforming brands to shore up balance sheets. Acquisitions are already up considerably in 2021, with sales of acquired brands through July already reaching USD5.2 billion, better than all but two full years across the historic period.

Nestlé has been the most active buyer in 2021, adding to its fast-growing VDS portfolio by purchasing all the VDS brands from Nature’s Bounty, one of the leading global players, to add to the company’s purchases of Vital Proteins and IM HealthScience in 2020 and Nuun in 2021. On the OTC side, GlaxoSmithKline and Sanofi resumed their stated plans to offload non-core brands before rumoured spin-offs of their consumer health divisions in 2022.

Trends driving consumer health growth in 2021

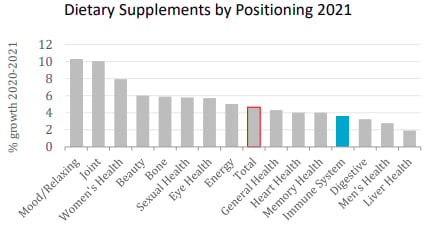

Immunity-positioned dietary supplements witnessed an unprecedent sales surge in 2020 with growth in interest in leading markets like the US reaching levels never seen. In 2021, interest in immunity has receded as the initial fear of the virus – the trigger that propelled interest in immunity – began to dissipate, as more consumers are vaccinated and have somewhat relaxed their lifestyles. Instead, interest is shifting to other health concerns that were laid bare during COVID-19, like stress, energy, beauty, joint and bone health, and others. Increasingly, consumers are adopting a combined approach to protect against illness, viewing their supplement regimen more holistically and through a lifestyles and nutritional lens rather than independently by evaluating narrower health needs.

Adjacent to the rise of multiple need-states is the renewed focus on mental health during the pandemic. Longstanding concerns around mental and emotional health abounded before COVID-19, as pervasive byproducts of the modern world. COVID-19 supercharged this effect, with the acute stress of the virus’ spread/lockdowns/social distancing depleting many people’s abilities to cope even further. This recognition of the importance of mental health is likely to lead to new demands for products and services in the coming years. Consumers are increasingly making the connection between behavioural and environmental factors on the one hand and the products they choose to engage with (such as the medicines they take, the foods they eat, and the supplements they use). As a result, future developments in mental health will necessarily have to include not just a drug/supplement-orientated approach, but also will have to integrate behavioural elements like relaxation/meditation, activity, and health tracking for any gains to be realised.

What’s to come after 2021

The outlook for consumer health products during COVID-19 has been tied directly to the norms and behaviours that consumers have adopted. Social distancing, masking, home seclusion, and others have limited consumers’ need for many consumer health products. How these behaviours shift, not just into 2022, but in the forecast period in general, is critical in understanding to what degree (and how fast) interest in consumer health categories evolves moving forward.

Longer term, though, consumers are likely to request more from the consumer health products with which they engage, and as a result, leading brands, especially those on the premium end of the spectrum, will have to do a much more credible job of demonstrating value. Above all, this will mean an emphasis on transparency in all forms, from methods to ingredients to supply chain. To answer these client demands, companies will be required to lead with science, demonstrating how a product works and certifying through testing and accreditations that it does what it claims and includes the ingredients it says on the package.

Finally, successful brands moving forward will have to be greater stewards of knowledge and invest a considerable amount more on consumer education and outreach, not just for promotion but to directly inform consumers why a certain product is beneficial for their health goals. Personalisation is a critical building block towards this new world of demonstrating value, as analytics and empirics will be essential tools to build trust and justify price points.